Churn: When A Few Basis Points Can Cost You Millions

- By Richa Gupta & Todd Wadtke

- Read Time: 3 Min

Unlocking the power of churn analytics

Selling relationships, not products, is the future of business. Every purchase is drifting into an ongoing service, whether that’s AI, fitness, books, or enterprise software. The subscription economy is becoming the most reliable engine of long-term wealth (consider Adobe’s pivot from boxed software to cloud services, which has led to a fourfold market growth since 2019). Business-model change is accelerating, and the greatest risk is failing to lead the shift.

Churn is the linchpin KPI for most subscription-based businesses today. Stakeholders and investors obsessively track annual recurring revenue (ARR), and churn is the fastest way to dent it. Additionally, churn directly shapes customer lifetime value (CLV) and cash-flow predictability, vital signals that raise your company’s value.

In fact, acquiring a new customer costs 5–25 times more than retaining one; a 5% lift in retention can raise profits by 25–95%. Your odds of a sale are 60–70% with existing customers versus 5–20% with new prospects. That’s why churn reduction is often the metric of success for subscription P&Ls.

Benchmarks vary, but across industries, annual churn often ranges between 5–7% in enterprise software and about 18% or more in consumer services. As more products move to subscription, churn becomes the operational heartbeat, showing whether revenue is compounding into future growth or slipping silently out the back door.

For example, let’s zoom in on telecom, where subscription is the default, ARR is king, and churn swings billions.

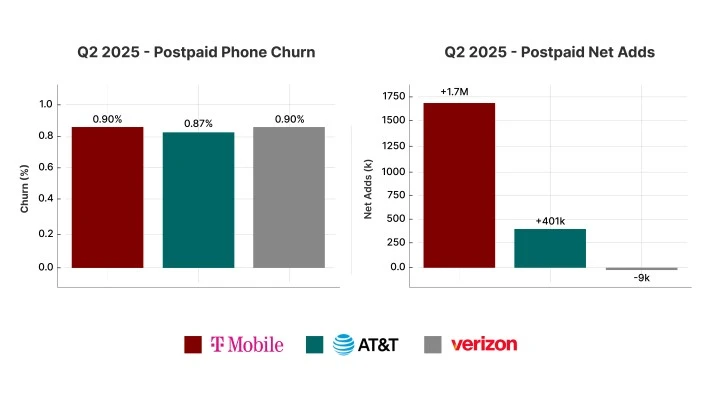

In Q2 2025, a few basis points told a billion-dollar story. T-Mobile kept postpaid phone churn at 0.90% while adding about 1.7 million postpaid customers. AT&T added 401,000 postpaid phone lines with postpaid phone churn of 0.87%. Verizon slipped to a net loss of 9,000 postpaid phone subscribers, with postpaid phone churn of 0.90%. Same market, same quarter, very different outcomes.

Across telecom, annual churn often runs ~15–25%, while monthly postpaid phone churn at big carriers sits well below 1%. That gap is why tiny basis-point moves each month compound into big dollars by year-end, and why smarter prediction and timely interventions pay off.

Everyone faces the same stressors, including promo expiries and price changes, local network hiccups, care backlogs, billing failures, end-of-term devices, and aggressive offers one port-out away. The difference lies in who predicts and pre-empts those triggers first, consistently, and without widening privacy exposure.

You can cut churn and keep privacy tight at the same time. Test ideas in the cloud with privacy-safe “look-alike” data (synthetic data that mimics patterns, not people) so personally identifiable information (PII) never moves. Use simple grouping-and-scoring to turn messy tables into clear, explainable signals for proven models. Then run a weekly cycle with one question, one small test, one decision under the controls you already have.

Churn is a financial lever, not just a marketing metric. It directly shapes annual recurring revenue (ARR), customer lifetime value, and cash-flow predictability, vital signals investors price into your company.

How we reduce churn without exposing customer data

1. Use privacy-safe “look-alike” data:

Create synthetic records that mimic your customer patterns (differentially private synthetic data) so teams can test ideas in the cloud without moving personally identifiable information.

2. Understand and act on overall churn drivers:

Track churn monthly and annually. Prioritize the segments with the biggest dollar impact. Act on the repeat offenders such as price/promo changes, product or service pain, support friction, billing failures, and end-of-term contracts/devices.

3. Keep models simple and explainable:

Start with Logistic Regression and a Decision Tree/Random Forest. They’re fast, easy to explain, and quick to approve. Add complexity only if it clearly beats these baselines.

4. Test safely, then ship and learn:

Test on a separate real sample that stays inside your walls. Measure business impact (fewer disconnects, lower cost per save), not just accuracy. Plug scores into your decision engine, A/B against business-as-usual, and keep iterating. Teams work on synthetic data, your cloud holds less raw PII, and privacy exposure stays flat.

5. In review meetings, keep it simple:

If churn improves, ARR compounds. In many subscription businesses, that’s the scoreboard.

What this unlocks next

Once your retention stack runs on synthetic training data, teams prototype faster, share safely with partners, and scale new use cases without expanding the Personally Identifiable Information exposure footprint. The same pattern extends to cross-sell, collections, fraud early-warning, and network experience models.

If promo wars, outage spikes, and call-center backlogs are making every basis point of churn feel expensive… you’re not alone. The good news is that you can learn faster without widening your privacy exposure with a retention program that uses privacy-safe “look-alike” data (differentially private synthetic data), simple grouping-and-scoring (adaptive Weight-of-Evidence), and a weekly learning loop. It allows you to experiment safely, see clearer signals, and ship small wins every week. A few basis points in monthly churn equals big dollars over a year, while privacy rules only get tighter. Synthetic data lets teams test in the cloud without moving PII, the models stay explainable for boards and regulators, and the loop turns every week’s noise into next week’s edge.