Leadership: The Missing Input in AI for Renewables

- By Manaswitha Rao & Todd Wandtke

- Read Time: 4 Min

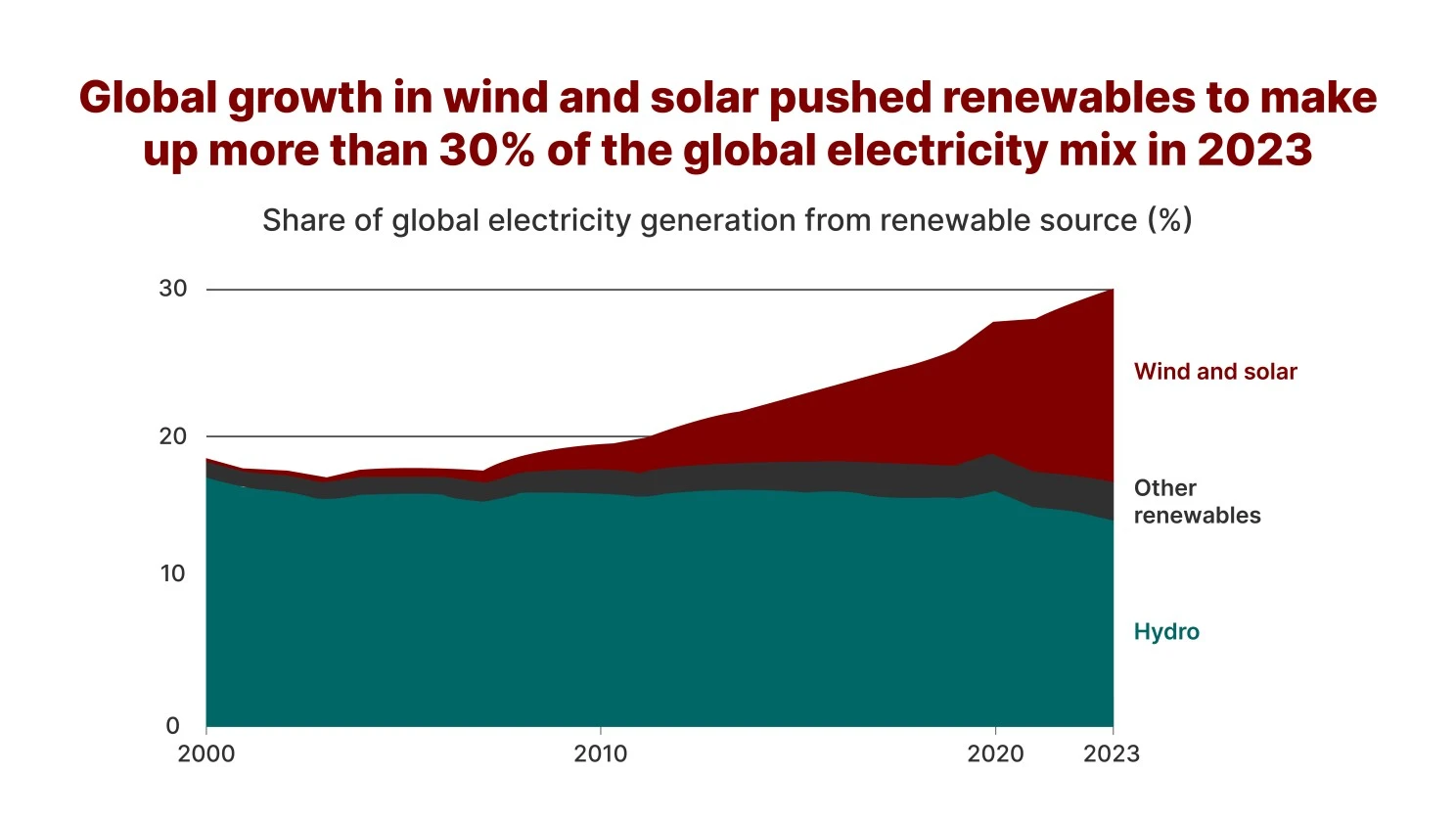

In the energy transition, inefficiency is a balance-sheet liability. As renewable energy passes 30 percent of global electricity, renewable operators face hard realities: variability (weather- and time-driven swings in wind and solar), rising curtailment (intentional cutbacks during congestion or oversupply), clogged interconnection queues, storage complexity, broader cyber risk, and tighter R&D funding.

Variability drives reliability and revenue exposure, so forecasts must map to bids and reserves. Curtailment erodes revenue, so storage arbitrage and smarter dispatch must cut dollars per MWh lost. Interconnection delays choke growth, so we prioritize sites by expected value per constrained MW. Storage complexity is margin, so charge and discharge must track prices and ramp limits. Cyber risk is incident probability and impact, so detection and fallback must sit beside bidding.

Generative AI (GenAI) is already working where these pressures live, i.e., short-horizon forecasting, battery-aware dispatch, stability monitoring, and market operations. But value appears only when leadership acts as a technical input: define “good enough” and tie it to revenue, cost, reliability, and risk.

The world is consuming more renewable energy driven by record solar and wind growth. 2023 set a record for new renewable capacity at roughly 510 GW. Clean-energy investment topped $2 trillion in 2024, out of more than $3 trillion in total energy spend. Variability is showing up on the grid in curtailment statistics. The global energy storage market rapidly grew as turnkey system costs kept falling. Ambition is rising too, with International Energy Agency (IEA) scenarios pointing to multi-terawatt additions this decade.

Forecasting, optimization, and stability detection are ripe for lift. Deep learning ensembles beat classic baselines for wind and solar nowcasting. Pair those forecasts with predictive control, and it can potentially boost the bottom line. One community microgrid example jumps almost twenty percent in income once forecasts feed dispatch. Hybrid Convolutional Neural Network- Long Short-Term Memory (CNN-LSTM) models accurately flag transient instability. Feature selection matters as much as model choice for solar radiation. And yes, cyber risk is very real in transactive energy markets, so detection and graceful fallback need to be part of the bidding strategy.

So why does the value derived from AI still feel slippery at enterprise scale? Because generative systems return endless ‘right’ answers. Two forecasts can both be defensible and still lead to different dispatch choices. Two summaries can both be readable and still nudge operators in different directions.

The hinge is leadership. Define the performance metrics and wire them to revenue, cost, reliability, and risk. Set Accept and Reject standards, attach uncertainty bands to every forecast, and publish decision policies that map priorities to bids, reserves, and alerts. Make security checks first-class. When executives author these rules up front, GenAI turns into EBITDA, lower emissions per MWh, and fewer incidents.

The leaders who set context today will own the energy markets of tomorrow.

Here is the mindset that closes the value gap.

Treat leadership as part of the stack.

Pick owners for each use case and write the value statement in plain language. We win when curtailment [RK5] drops by X, when reserve margins hold at Y with lower cost, when carbon intensity per megawatt-hour falls below Z. Do this step before you debate model architectures.

Convert taste into rules.

Endless right answers need acceptance thresholds, not beauty contests. Define Accept versus Reject with rubrics for correctness, safety, tone, and actionability. Add uncertainty bands to every forecast and make operators accountable. Calibration is a feature, not an afterthought.

Measure impact where it actually lands.

Forecast error in isolation is an ego metric. Tie models to decisions. Your north stars are cost to serve, emissions intensity, reliability indices, and market revenue. Run controlled experiments. Keep human ratings as a proxy, but let a real key performance indicator decide the promotion.

Close the loop on learning.

When an output is rejected, capture why. Feed the reason back into prompts, policies, fine-tunes, and data contracts. Endless right answers become better answers when the system remembers what your organization believes is valuable.

If generative AI supplies the answers, context supplies the rails. Mu Sigma’s Akashic Architecture gives your models a shared brain, so the right answer advances your objective.

- Ontologies and knowledge graphs establish a shared vocabulary for assets, weather feeds, market rules, and compliance constraints, so models see consistent truth across plants, seasons, and regions.

- Question networks encode how operators really think, linking “will we exceed ramp limits in the next 15 minutes” to “should we pre-charge storage” to “what bid goes to the 5-minute market.”

- Composable macros and agentic AI turn design intent into executable workflows. Level 1 agents plan and quality check. Level 2 agents generate code and execute against those macros, then route for human review.

- Continuous Service as a Software keeps the loop alive. A service that learns in production, not a one-off model drop.

Forecasting upgrades flow into decision optimization, which flows into a security posture that anticipates false-data injections and gateway attacks, which flows into operator tooling that surfaces uncertainty and expected value, not just pretty lines. The stack speaks one language, the models have guardrails, and the business metrics move.

A Path Forward

- Define acceptable, then we scale.

- Do not deploy a forecast without a paired decision policy and a measured KPI.

- Fund data contracts and calibration at the same priority as model training.

- Ship explainability that an operator can use, not a slide about attention maps.

- Track cost per accepted output, time taken to accept outputs, and emissions per megawatt-hour as first-class metrics.

If you do this, endless right answers stop being a liability. They become optionality. Your operators choose from multiple acceptable futures with clarity about cost, carbon, and risk. Your board sees a line of sight from model improvements to enterprise value. Your regulators hear a coherent story about safety and fairness. Your customers experience reliability with a greener footprint.

The leaders who set context today will own the energy markets of tomorrow. Start with one high-value forecasting-to-dispatch loop, define your acceptance thresholds, and measure the lift in dollars and emissions saved. The companies that wait will find their grids and their strategies run on vibes instead of value.